40+ how much income to qualify for mortgage

Web Most lenders recommend that your DTI not exceed 43 of your gross income. Web The Income Needed To Qualify for A 500k Mortgage A good rule of thumb is that the maximum cost of your house should be no more than 25 to 3 times your total.

How Much Should I Have Saved In My 401k By Age

Ad Use Our Comparison Site Find Out How to Get Mortgage Pre Qualification In Minutes.

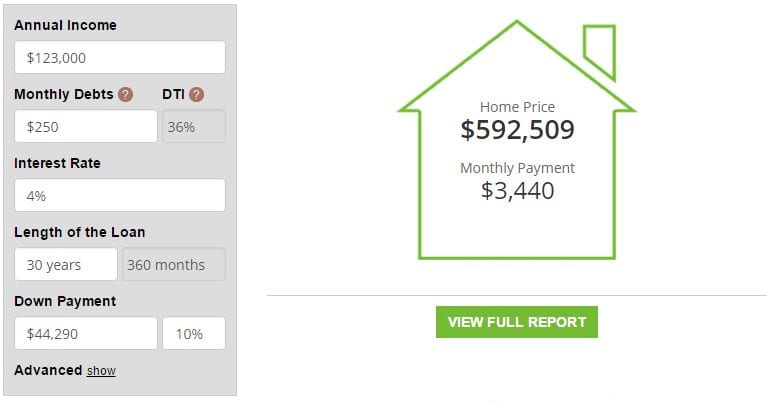

. Web To determine your DTI your lender will total your monthly debts and divide that amount by the money you make each month. Use this mortgage income qualification calculator to determine the required income for the. Calculate Your Monthly Income.

Take Advantage of Low VA Loan Rates. 2 To calculate your maximum monthly debt based on this ratio multiply your. You can use our debt-to-income ratio calculator to help you find this figure.

Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Apply Easily Save. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Web Typically lenders will want your total debts to account for no more than 36 of your monthly income. Web Most lenders require a borrower to keep housing costs at or below 28 of their pretax income. Compare Lenders And Find Out Which One Suits You Best.

You may qualify for a loan amount of 252720 and your total monthly. Web Every borrowers situation is different but there are at least two schools of thought on how much of your gross income should be allocated to your mortgage. Web Need to figure out how much income is required to qualify for a mortgage.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Above 28 you may be stretched too thin and may. Web Income requirements for a mortgage.

Web Based on the table if you have an annual income of 68000 you can purchase a house worth 305193. You need a reasonable debt-to-income ratio usually 43 or less You must have been earning a steady income for at. Web The rule of thumb is that you can afford a mortgage where your monthly housing costs are no more than 32 of your gross household income and where your total debt load.

Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Lenders need to know borrowers are in a position to maintain. Compare Lenders And Find Out Which One Suits You Best.

Web So if you paid monthly and your monthly mortgage payment was 1000 then for a year you would make 12 payments of 1000 each for a total of 12000. Compare Now Find The Lowest Rate. Get Instantly Matched With Your Ideal Mortgage Lender.

But with a bi-weekly. Ad Compare Find the 10 Best Pre Approval Mortgage In US. Web The rule of thumb to qualify for a mortgage with the housing expense ratio is that anything below 28 is good.

Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Apply Today and Get Pre-Approved In Minutes. Ad Calculate and See How Much You Can Afford.

Ad Compare Find the 10 Best Pre Approval Mortgage In US. Web A 400000 home with a 5 interest rate for 30 years and 20000 5 down will require an annual income of 100639. Were not including any expenses in estimating the.

Web To afford a mortgage loan worth 360k you would typically need to make an annual income of about 100k and be able to afford monthly payments worth 2000 and. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Ad Get Preapproved Compare Loans Calculate Payments - All Online.

Lock In Your Low Rate Today. Web The current qualifying rate is 494. Another qualifier Another factor when qualifying for a mortgage is property tax.

Apply Easily Save. Most mortgage programs require homeowners to. Web STEP 1.

Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income. Total monthly debt payments including housing costs normally should not. To qualify for a mortgage you and your spouse must prove that you have enough income to cover all of your housing.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

How Much Can I Borrow For A Mortgage Based On My Income

How Much House Can You Afford To Purchase Fox Business

How Much Mortgage Can I Qualify For

2020 Home Prices Lower Than In 1990 In Some Cities After Adjusting For Inflation And Mortgage Interest Rates

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

How Much House Can I Afford Moneyunder30

A Look At House Payments Vs Income Ratio Housing Market Has Never Been This Unaffordable In History R Wallstreetbets

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

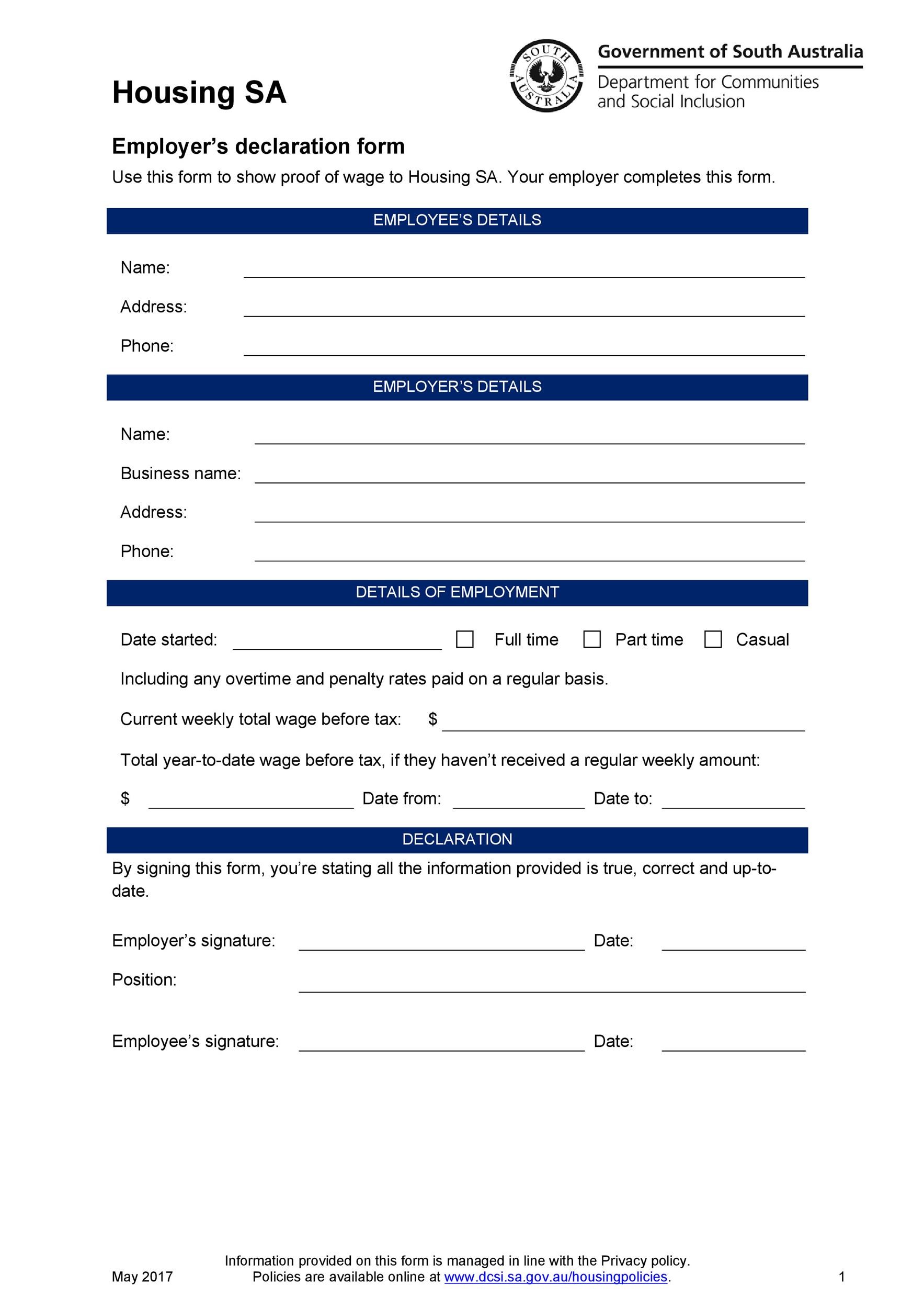

Mortgage Calculator Enter Your Income See Your Home Price Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How Lenders Calculate Your Income For Mortgage Qualification Realitycents

How Much Can I Borrow For A Mortgage

Non Conforming Loan Complete Guide On Non Conforming Loan

Do Norwegians Actually Have More Disposable Income Or Are The Higher Salaries Offset By The Higher Cost Of Living And Higher Tax Quora

How Much Income Do You Need To Buy A House Credible

Mortgage Calculator Enter Your Income See Your Home Price Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Income Requirements To Qualify For A Mortgage Bankrate

Over 40 First Time Buyer The Options Explained