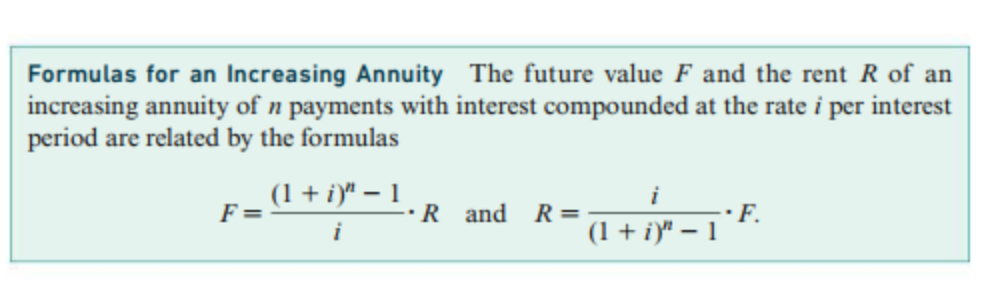

Increasing annuity formula

A simple example of a growing annuity would be an individual who receives 100 the first year and successive payments increase by 10 per year for a total of three years. The formula for Annuity Due can be calculated by using the following steps.

Growing Annuity Formula With Calculator Nerd Counter

Ad Learn More about How Annuities Work from Fidelity.

. Stands for the present value of the above annuity ie an iIani limImam. The formula for the growing annuity encompasses all of the other formulas. In this equation the first payment C.

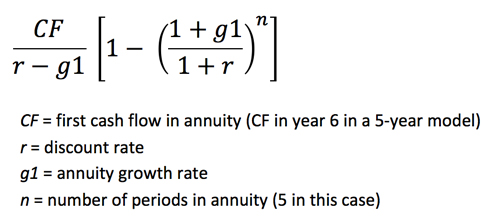

The formula discounts the value of each payment back to its value at. Ad Learn More about How Annuities Work from Fidelity. Future Value of a Growing Annuity Formula.

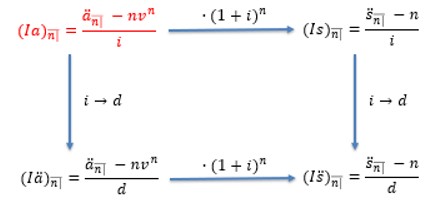

G growth rate. This increasing demand on your retirement fund must be factored into a proper RRSP savings plan. This is a collaboration of formulas for the interest theory section of the SOA Exam FM CAS Exam 2.

FV Pmt x n x 1 i n-1 The future value of a growing annuity formula is one of many annuity formulas used in time value of money calculations discover another at the links. Firstly determine the nature of payments for annuity ie they should be paid at the beginning of. R interest rate.

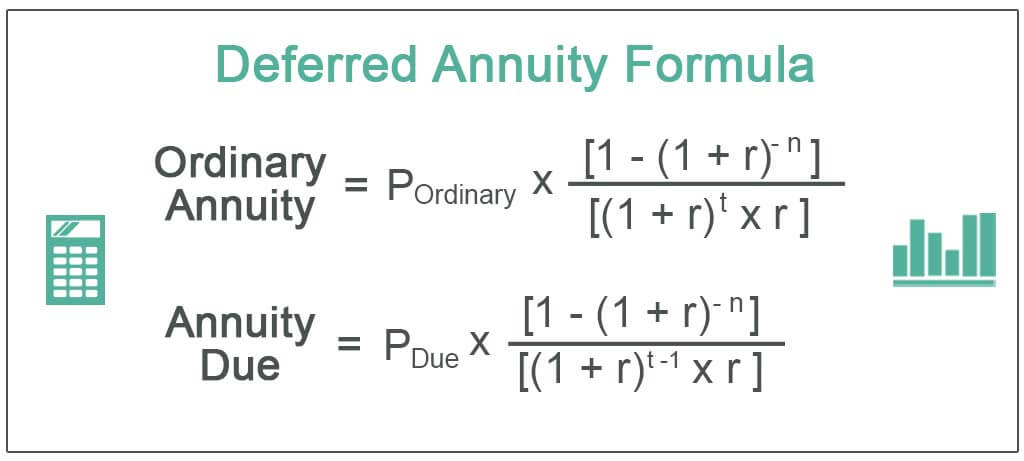

A growing annuity can also be known as an increasing or graduated annuity. An annuity-due is an annuity for which the payments are made at the beginning of the payment periods The first payment is made at time 0 and the last payment is made. It can be referred to as an increasing annuity as well.

A growing annuity is an annuity where the payments grow at a particular rate. The mathematical derivation of the PV formula. This study sheet is a free non.

Payments by the Canada Pension Plan and Old Age Security along with. The payments are made at the end of each period for a fixed number of periods a discount rate is. This would be a.

PV Pmt x 1 i x 1 - 1 g n x 1 i -n i - g PV 8000 x 1 6 x 1 - 1 3 10 x 1 6 -10 6 - 3 PV 7054346. A growing annuity due is sometimes referred to as an increasing annuity due or graduated annuity due. Exam FM2 Interest Theory Formulas.

Ad 11 Tips You Must Know About Retirement Annuities Before Buying. The growing annuity due formula can easily be calculated by present-day value at a proportionate rate. Learn why annuities may not be a prudent investment for 500000 retirement portfolios.

N number of periods. Ad Get this must-read guide if you are considering investing in annuities. The present value of an annuity is the current value of a set of cash flows in the future given a specified rate of return or discount rate.

Growing annuity formula Example. C cash value of the first payment. Present Value Of An Annuity.

For example assume that the initial payment is 100 and the payments are expected to grow each period at.

Annuity Formula Annuity Formula Annuity Economics Lessons

Future Value Of A Growing Annuity Formula Double Entry Bookkeeping

Present Value Of A Growing Annuity Due Formula Double Entry Bookkeeping

Present Value Of A Growing Annuity Formula With Calculator

Growing Annuity Payment Formula Fv Double Entry Bookkeeping

Growing Annuity Equation With Description Tote Bag For Sale By Moneyneedly Redbubble

12 2 Constant Growth Annuities Mathematics Libretexts

Arithmetically Increasing Annuities Soa Exam Fm Financial Mathematics Module 2 Section 6 P1 Youtube

Increasing Annuities Youtube

Present Value Of A Growing Annuity Formula Double Entry Bookkeeping

Solved Formulas For An Increasing Annuity The Future Value F Chegg Com

How To Model Multi Stage Terminal Values The Marquee Group

Annuities Cash Flows With Non Contingent Payments Cfa Frm And Actuarial Exams Study Notes

Present Value Of A Growing Perpetuity And A Growing Annuity Youtube

Deferred Annuity Formula How To Calculate Pv Of Deferred Annuity

Present Value Of A Growing Annuity Example 1 Youtube

Present Value Of A Growing Annuity Formula With Calculator